NetEnt Stock Analysis – Updated January 2022

On this page, you will find the latest analysis, news, and forecast for the NetEnt stock. First, we will give a quick overview of this casino game You will find the most recent NetEnt stock analysis, news, and forecasting information on this page. First, we’ll give you a quick rundown of this casino game developer’s history. Following that, we will go into deeper depth and look at the key drivers of prospective growth, such as the merger of Red Tiger and the development of NetEnt Live, in greater depth. In the upcoming sections, we examine the financial statements before concluding by summarizing the projected target price for the NetEnt stock in 2022. Read on for updated and detailed information on NetEnt’s Stock analysis.

NetEnt History

The company was founded by Swedish entrepreneurs in 1996. In 2007 it was spun off from Cherry. The stock had its peak in 2015-2016 with an all-time high (ATH) at 95,55 SEK. As of writing this article, the stock price is 24,30 SEK. This means that the company lost 75% of its value. The past years have been challenging and 2019 was no exception with a 30% decline in the stock price. There is, however, as Therese Hillman mention in the latest report (Q4 2019) hope for the future.

Quick Facts

Name: NetEnt AB

Stock Symbol (Ticker): NETB

Dividend 2020: 1 SEK per share approx 4,1%

“We see good conditions for NetEnt to deliver growth in 2020, supported by our combined game portfolio and Live Casino”

Therese Hillman

NetEnt Stock Analysis Update December 2021

After a challenging year filled with numerous regulations, Red Tiger and Live Casino have emerged as the most significant growth drivers. However, we will briefly mention NetEnt Connect, the recent Insider Trades, and USA potential. As a result, we will concentrate on the factors listed below.

Red Tiger

On the 5th of September NetEnt acquired Red Tiger. Since the acquisition, Red Tiger has launched 19 new games. The main competitive advantage with Red Tiger is the daily jackpots but also the low production cost and high productivity of quality games. Below we list the two main reasons why we think Red Tiger and NetEnt will do great together.

First, new and innovative games can be developed together. With the acquisition, NetEnt now has access to Megaways and Daily Jackpots. Megaways is a unique concept from the Australian company Big Time Gaming which means that the slot has 117,649 paylines. Giving players the chance to win big. Red Tiger has a good deal with Big Time Gaming. Daily Jackpots is developed by Red Tiger. Daily Jackpots are progressives who are guaranteed to pay out before a set time each day. A great community product that’s gone truly viral. Red Tiger launched Piggy Riches Megaways at the end of January. It is based on NetEnt old classic game Piggy Riches but has the Megaways functionality and Daily Jackpot plus Smart Spins (an engagement tool to give away free spins that are also developed by Red Tiger). It was according to the latest quarterly report the best game release ever from Red Tiger. Later this year, NetEnt will also release Starburst Power Pots which is based on NetEnts most popular game ever, Starburst. We are sure NetEnt will make more of these innovative co-produced games with new games featured that can accelerate the growth.

Secondly and maybe more important, Red Tiger can use the network of contacts to sign partnerships with many new casinos that NetEnt already has an established relationship with. This means that Red Tiger´s games will be released on many new markets, both regulated and unregulated. This will, of course, accelerate the growth even further for Red Tiger games. Here are the new partnerships that have been released so far:

- GentingBet, October 7, 2019

- Cherry Casino, October 14, 2019

- Interwetten, October 21, 2019

- No Account Casino, October 30, 2019

- Novibet, November 6, 2019

- 777.ch, December 6, 2019

- Swiss Casinos, December 16, 2019

- Royal Panda, December 20, 2019

- Lottogo, January 7, 2020

- Nike, January 30, 2020

- BoyleSports, February 19, 2020

- SoftSwiss, February 24, 2020

NetEnt Live

NetEnt Live has been a catastrophe for NetEnt for a very long time (was initially launched in 2013). The product has not been good enough. NetEnt got to see Evolution Gaming (EVO) completely owning the niche. EVO has been growing rapidly and just in the last 3 years, the stock has increased by more than 400%. The new NetEnt Live was initiated at the end of 2018 when Henrik Fagerlund was appointed as the Acting Netent Live Director. Henrik has been with NetEnt since 2014 and owns quite a lot of NetEnt stocks. Just in the last 6 months, he has bought stocks on 3 different occasions. Henrik had the Acting NetEnt Live Director from September 2018 to February 2019. On his LinkedIn Henrik writes: As acting NetEnt Live Director “I was overseeing the “Big 5″, being Commercial, Product, Dev, Studio, and Tech Ops teams. The 2 biggest achievements, by far, during this short tenure, was to set a new product strategy and to close top recruitment of the permanent NEL Director which is Andres Rengifo (from Evolution Gaming Top Management).”

From February 2019 NetEnt have new management for NetEnt Live with Andres Rengifo and several other people. Andres comes from top management at EVO. It took a year for Andres and the team to turn NetEnt from having bad products to having products that according to us can compete with EVO. So far NetEnt has very few live casino games and is far behind EVO, especially when it comes to Game Shows and so on. But for regular Blackjack and Roulette NetEnt Live now has very good products.

Here is the development of NetEnt Live according to the last quarterly reports:

“Within Live Casino, we now have a new management team in place that are making changes to the product and business model to ensure that we can offer a competitive product.”

Q1 Report 2019

“The transformation of Live Casino continues at full speed and we added several new functions during the quarter to make our product more competitive. The customer response is positive, and we expect growth in the coming quarters from this segment, but it will take a few more quarters before we can see more meaningful revenues.”

Q2 Report 2019

“Within Live Casino, we continue to pursue our plan to make improvements to the product and organization. We rolled out an upgraded user interface for a better player experience as well as products such as Perfect Blackjack and Network Branded Casino to our customer network.”

Q3 Report 2019

“Since December, we have seen all-time highs in player numbers for our Live Casino. We are now expanding the studio in Malta and will soon be offering physical tables to our customers for the first time, as an alternative to our tables with blue screen technology, which should contribute to increased revenues from Live Casino in 2020.”

Q4 Report 2019

Many new products and enhancements to existing products have been made. Here is a list of some of the major news from NetEnt Live in the last 6 months.

- Launches Perfect Blackjack across the Network, September 30, 2019

- Network Branded Casino, October 7, 2019

- New design for Blitz, October 17, 2019

- Wins price for Live Casino, November 11, 2019

- Auto Roulette Studio, December 3, 2019

- New VIP BlackJack, December 16, 2019

- Enhanced Mobile Live Roulette, January 9, 2020

- New Studio with the Silver and Gold Rooms, February 24, 2020

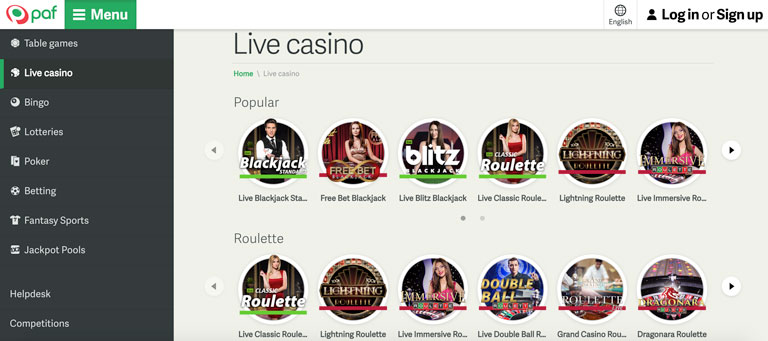

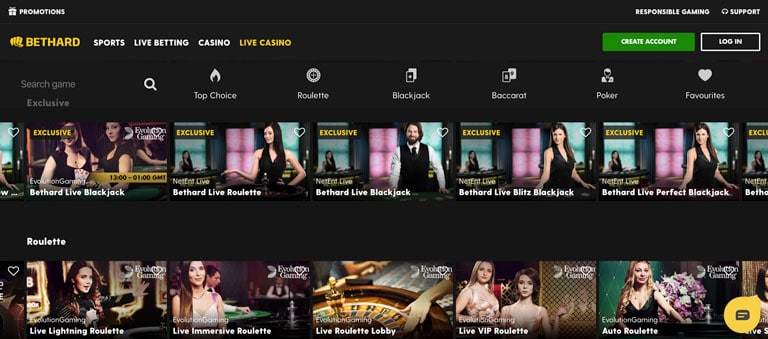

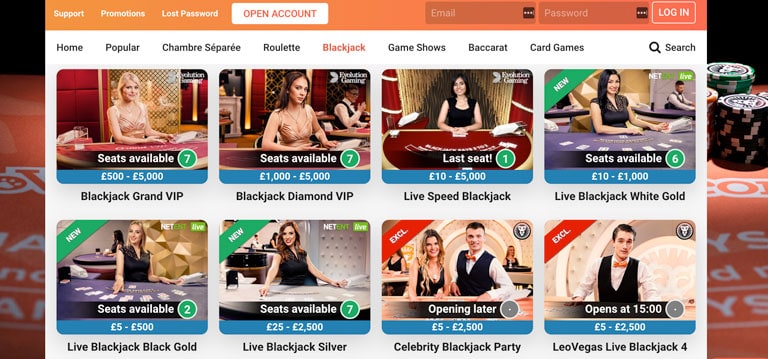

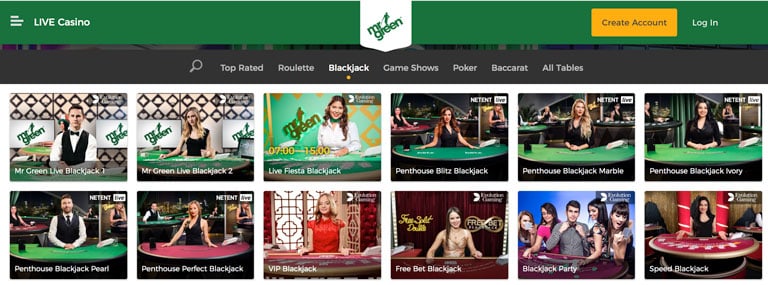

If you are not convinced that NetEnt Live is on the right track. Maybe the best way to analyze its products is to go to the different online casinos and actually see how much exposure NetEnt Live gets. As you can see NetEnt starts to get quite a lot of exposure on several casinos. With increased quality in the products, it should not take long before NetEnt can sign new partnerships with their Live Casino offerings.

It is difficult to say which of NetEnt Live products will be most successful. NetEnt has a more cost-effective product for branded Live Casinos compared to EVO. The name of the product is Network Branded Casino (NBC). It uses “blue screen” technology so that each casino brand can get a customized look and feel of the Live Casino Studio. With the blue screen technology, many casino brands use the same dealers and the same physical rooms but change the background and branding of the room. It can in this way be branded over and over again. See this example from Bethard.

Other products that are popular are Perfect Blackjack, Blitz Blackjack, Auto Roulette, and the two new physical rooms Silver and Gold. Later this year Baccarat will also be released.

NetEnt Connect

Another project that could be successful going forward is NetEnt Connect (an aggregation platform) that was launched in December 2019. It is a great way of getting Red Tigers content to NetEnt’s already existing customer base. NetEnt is also connecting additional game developers to this platform. In addition to Red Tiger also Games Inc, G (formerly known as Gluck Gamevy) and Scout Gaming Group have connected to the platform. We believe that this platform will also be a great tool and platform for NetEnt when acquiring other game developers and want to get the games out quickly.

NetEnt USA

The development for NetEnt in the USA has been great and NetEnt continues to grow fast in this market. We see a lot of potential for NetEnt in the US going forward. There are many triggers but two main ones are if Red Tiger will launch their games and that if NetEnt launches their Live Casino in the US.

NetEnt Recent Insider Trade

Henrik Fagerlund, the company’s Managing Director in Malta, Therese Hillman, the company’s CEO, and Pontus Lindwall, another board member, all purchased stock after the fourth-quarter 2019 report was revealed on February 12th, 2020, according to the publicly available information. Despite the fact that Therese acquired a modest quantity, she is becoming more and more hopeful about the fascinating future. Both in her reports and presentations, as well as in her decision to purchase stock, she demonstrated a high level of professionalism.

Financials

NetEnt has done an excellent job of keeping costs under control in 2021. Because Red Tiger has a profit margin of at least 60%, we believe that the profit margins for NetEnt will increase over time. NetEnt has also budgeted for the development of NetEnt Live, so we anticipate that the costs will be lower, or at the very least that more revenue will be generated than costs due to increased investments in the Live Casino going forward.

Below you can find actual numbers for 2021, followed by our prediction for NetEnt this year. We’ll offer you our forecast for the price in 2022. The following is a list of some of the financial information.

Here are the actual numbers for 2021

| Quarter | Revenue | EBITA | EBIT | Profit |

| Q1 2021 | 418 | 197 | 126 | 120 |

| Q2 2021 | 419 | 201 | 130 | 120 |

| Q3 2021 | 443 | 196 | 112 | 84 |

| Q4 2021 | 512 | 261 | 161 | 113 |

Numbers in kSEK (million Swedish kronor)

Here are our forecasted numbers for 2022

| Quarter | Revenue | EBITA | EBIT | Profit |

| Q1 2022 | 520 | 265 | 170 | 150 |

| Q2 2022 | 540 | 275 | 175 | 160 |

| Q3 2022 | 560 | 285 | 180 | 165 |

| Q4 2022 | 580 | 295 | 190 | 175 |

Numbers in kSEK (million Swedish kronor)

- Number of stocks = 239 million

- Estimated PE =12

- Target price using Profit = 12 * 650 = 7800/239 = 32,6 SEK

- Target price using EBIT = 12 * 715 = 8580/239 = 35,9 SEK

- Target price using EBITA = 12 * 1120 = 13440/239 = 56,2 SEK

Our Target Price 2020 = 48 SEK

If NetEnt

Suppose NetEnt can develop at a faster rate than we anticipate. In that case, most of the new revenue will be converted into profit, resulting in a significant increase in the target price.

Summary of NetEnt Stock Analysis

In the year 2020, the stock was trading at 24,30 SEK. It follows that the stock price has the potential to climb by a factor of one hundred percent in 2022. Red Tiger and Live Casino have been the primary drivers of the stock’s double-digit growth. However, other factors are at play, including the United States, NetEnt Connect, and others. With the acquisition of Red Tiger, the corporation gains access to Megaways, Daily Jackpots, and a crew that can manufacture slots quickly and cost-effectively. Since its introduction, NetEnt Live has gained in popularity and has been included in an increasing number of casinos. In 2022, it is projected that more partnerships, games, and studios will be launched.

IMPORTANT INFORMATION FROM THE CASINOONLINE.CASINO

The content of this text may be freely copied provided that a clickable link to this site is also included. We like to emphasize that investments always involve risk. The reader of this analysis should therefore critically analyze and review the company on its own before making an investment.

For more investments alternatives, please check out our dedicated page about Gambling Stocks.